The Case for Diversifying into Residential Investment Property Loans

What’s a savvy originator to do in today’s market?

If you’re a loan originator focused on owner-occupied consumer mortgages, you’re probably experiencing a bit of nostalgia for the strong refinance activity that drove origination volumes sky-high in 2020 and 2021. Low interest rates and a housing frenzy led to unprecedented profitability in mortgage origination in the last two years, with mortgage lenders making as much as 6% per loan.

2022 is a different story. In a rising rate environment, consumer mortgage volumes are declining, and so is profitability. According to a May 2022 report by the Urban Institute, mortgage origination profitability is down to 2.8% in 2022 from the dizzying peak of 6% in 2020. This slowdown has forced originators to compete more aggressively on terms.

Diversify, adapt, and thrive

How do you grow your business under present conditions? The short answer – diversify and expand your product offering. There’s a huge market opportunity in residential investment property loans and DSCR loans. Adapt and thrive as rates rise!

Residential Investment Property loans are non-owner occupied business purpose mortgages that provide real estate investors financing to purchase investment properties, complete construction projects, and/or refinance properties they own.

DSCR loans are long term and generally 30-year loans for landlords and investors to purchase or refinance 1-4 unit and/or multifamily properties.

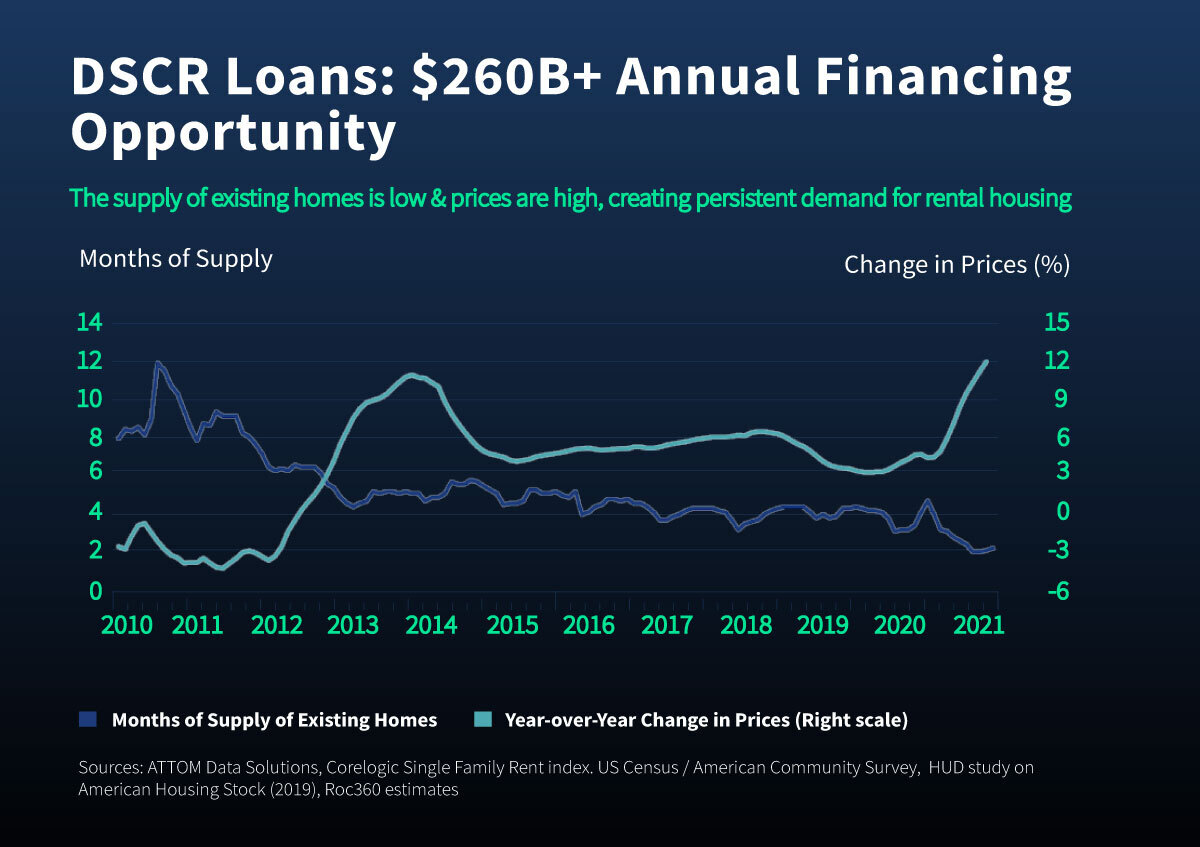

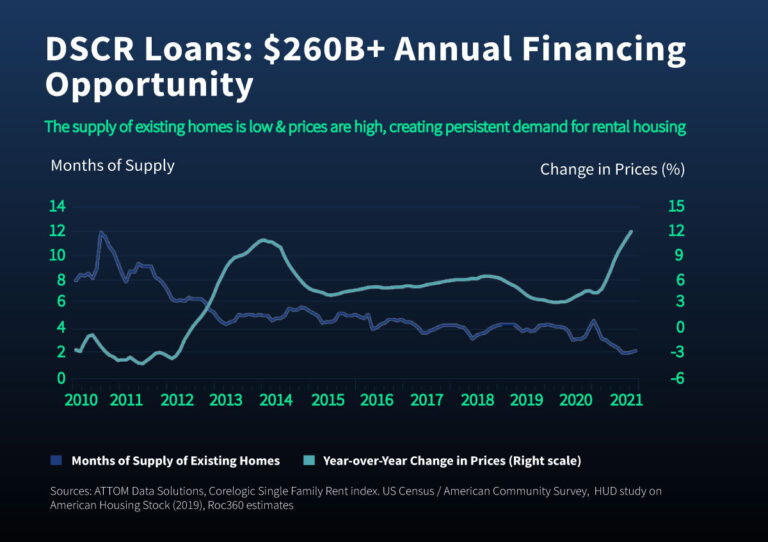

$260 billion market opportunity in DSCR loans

Despite the hiccups in the first half of 2022, the fundamentals of the housing market are strong. The supply of existing homes is low and prices continue to remain high, creating a persistent demand for rental housing. The annual financing opportunity for DSCR loans is estimated to be a whopping $260 billion. With 80% of U.S. homes being over 20 years old and in need of repair, the annual financing opportunity in fix-and-flip loans alone is over $50 billion. Fix-and-flip investors have the experience and the financial incentive to modernize U.S. housing.

Roc Capital can help you expand your product offering

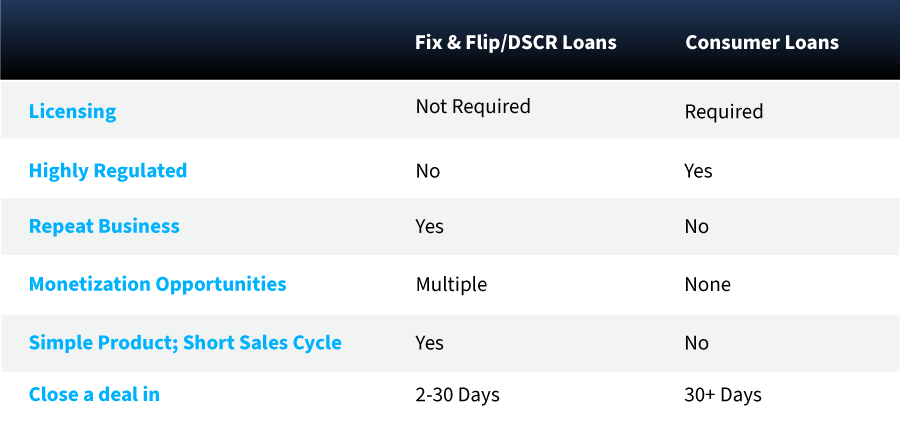

Not only does the outlook for real estate investor loans continue to remain strong, look how much easier life is on this side of the fence. Indeed, the regulatory environment, competitive landscape, ease of doing business, and multiple monetization opportunities are all highly attractive features. We can help you expand your product offering and grow your revenues:

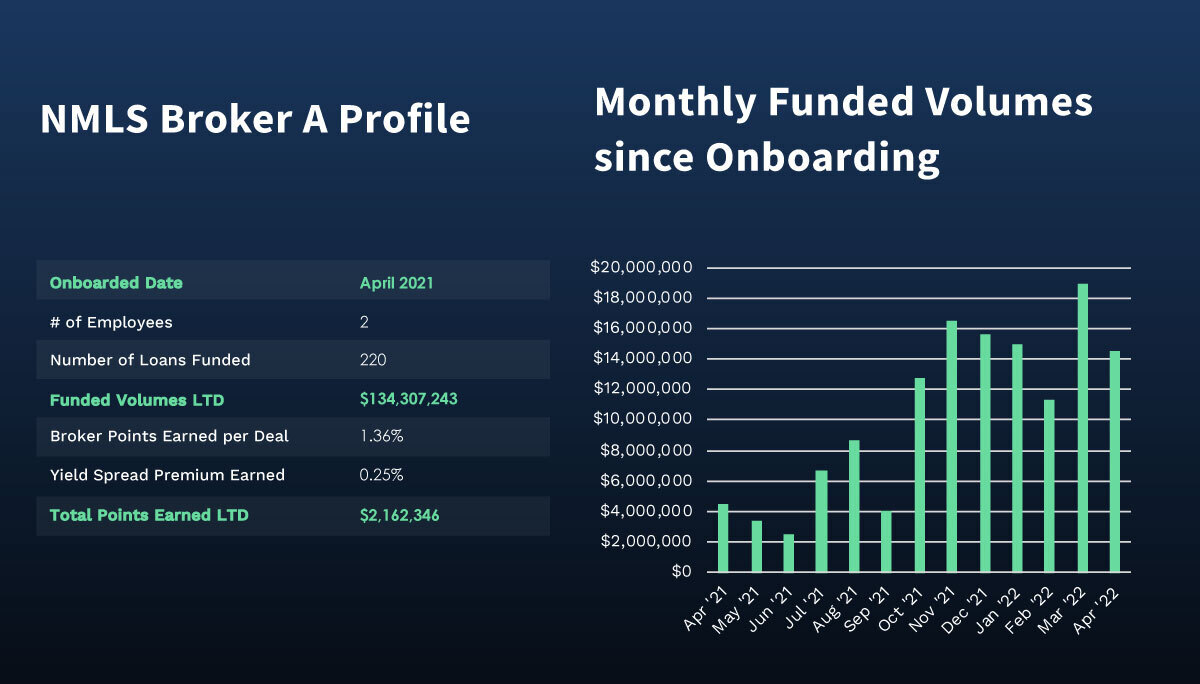

Case study: how Roc Capital enabled growth for an NMLS broker

An NMLS broker who first partnered with us in April 2021 quickly recognized an opportunity to originate and cross-sell real estate investor loans to landlords that they were previously unable to lend to. In just one year through April 2022, they were able to fund 220 loans with Roc Capital’s help – a total volume of over $134 million. They earned 1.36% in broker points per deal, with a yield spread of 0.25%. Not bad for a new business opportunity! Check out the numbers:

Grow your business with us!

Our #1 priority is to help you find the right products and pricing to grow your business!

We offer the widest range of loans so you can expand your product offerings and grow your business–fast! We only fund Fix-and-Flip and DSCR loans for non-owner occupied properties.

PRODUCTS

- Fix & Flip – short term loans to buy, renovate, and either sell or own-to-rent 1-4 unit homes.

- Ground Up Construction – short term loans to buy land and build to sell/own-to-rent 1-4 unit homes.

- Multifamily Bridge (Purchase) – short term loans to buy, renovate, and sell/own-to-rent 5+ unit multifamily properties.

- Multifamily Bridge (Refinance) – short term loans for rate/term or cash out refinance on 5+ unit multifamily properties that do not need renovation.

- Rental DSCR/Landlord Loans – 30-year loans for rental property owners and investors to purchase or refinance 1-4 unit and/or multifamily properties.

-

Fix & Flip

short term loans to buy, renovate, and either sell or own-to-rent 1-4 unit homes.

-

Ground Up Construction

short term loans to buy land and build to sell/own-to-rent 1-4 unit homes.

-

Multifamily Bridge (Purchase)

short term loans to buy, renovate, and sell/own-to-rent 5+ unit multifamily properties.

OFFERINGS

- Easily broker investor loans, or we can even fund them in your company name (white-labeling; no NMLS required!).

- White-labeled marketing materials.

- Easy process: Get answers quickly with concierge underwriting and service.

- Full technology suite with mobile app so you can submit loans on the go.

Contact Roc Capital today to get started!

See our recent posts

The Case for Diversifying into Residential Investment Property Loans

If you’re a loan originator focused on owner-occupied consumer mortgages, you’re probably experiencing a bit of nostalgia for the strong refinance activity that drove origination volumes sky-high in 2020 and 2021.

Financing Untapped Equity in Properties Owned by Non-professional Real Estate Investors

Ranajoy Sarkar, Roc Capital’s Chief Credit and Product Officer, is optimistic about the long-term health of the rental market and excited by the prospects of financing the significant untapped equity in properties owned by non-professional real estate investors.

The Private Lending Market Today: Cautious but Optimistic

Despite today’s macroeconomic conditions, the mood in private lending is cautious but still optimistic, says Roc Capital’s Adam Gottfried. A key reason: the fundamentals of real estate have never been stronger.

How Roc Capital Makes Loan Originations Fast, Easy, and Efficient

Roc Capital is uniquely positioned to be your trusted partner, especially in this rising rate market, thanks to our wide range of products, customer-friendly processes, a comprehensive suite of services ranging from white label table funding to full back office support and a full technology suite.

How Roc Capital Kept Rates Competitive for Our Clients

Speaking on the Mastering Wall Street panel at the Geraci Innovate Conference a few days ago, our Co-Founder Eric Abramovich discussed recent bridge loan securitization pricing and how Roc Capital has been able to keep rates competitive for our clients.

Looking Back at 2021, Looking Forward to 2022

Eric Abramovich, Roc Capital Co-Founder and Chief Credit Officer, looks back at 2021 and shares his thoughts on what we might expect in 2022.

Everything You Wanted to Know About Table Funding But Didn’t Know Whom to Ask

Eric Abramovich, Roc Capital Co-Founder and Chief Credit Officer, takes us on a journey of table funding — its history, how it works, and its role in bringing institutional capital to the “Wild West” world of private lending in real estate investing.

Bullish Outlook for U.S. Housing: My Thoughts from IMN’s Single Family Rental Forum in Miami

Share on facebook Share on twitter Share on linkedin What’s the outlook for the U.S. housing market in general, and rental housing in particular? Overwhelmingly