Financing Untapped Equity in Properties Owned by Non-professional Real Estate Investors

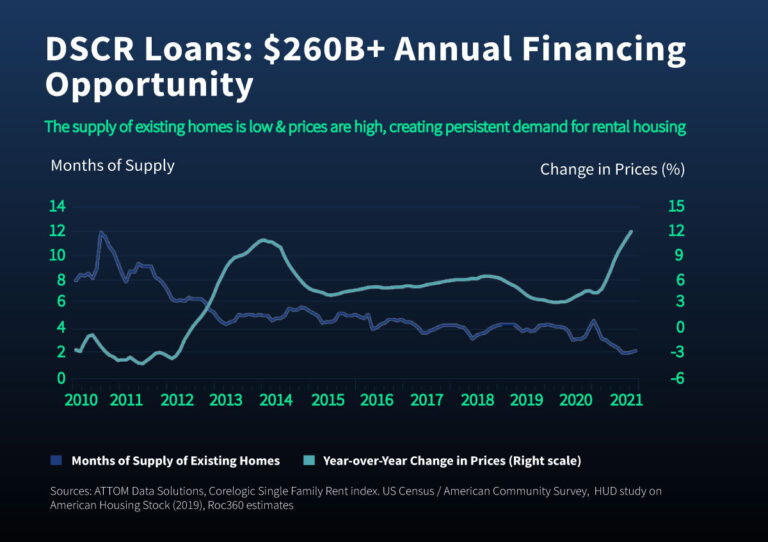

The market opportunity

See our recent posts

The Case for Diversifying into Residential Investment Property Loans

If you’re a loan originator focused on owner-occupied consumer mortgages, you’re probably experiencing a bit of nostalgia for the strong refinance activity that drove origination volumes sky-high in 2020 and 2021.

Financing Untapped Equity in Properties Owned by Non-professional Real Estate Investors

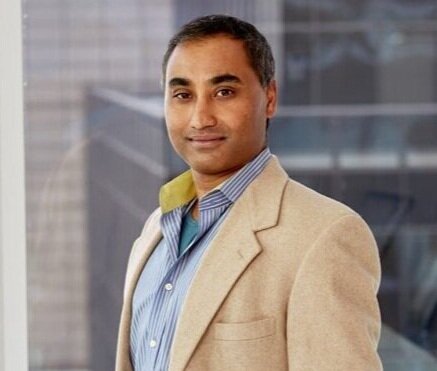

Ranajoy Sarkar, Roc Capital’s Chief Credit and Product Officer, is optimistic about the long-term health of the rental market and excited by the prospects of financing the significant untapped equity in properties owned by non-professional real estate investors.

The Private Lending Market Today: Cautious but Optimistic

Despite today’s macroeconomic conditions, the mood in private lending is cautious but still optimistic, says Roc Capital’s Adam Gottfried. A key reason: the fundamentals of real estate have never been stronger.

How Roc Capital Makes Loan Originations Fast, Easy, and Efficient

Roc Capital is uniquely positioned to be your trusted partner, especially in this rising rate market, thanks to our wide range of products, customer-friendly processes, a comprehensive suite of services ranging from white label table funding to full back office support and a full technology suite.

How Roc Capital Kept Rates Competitive for Our Clients

Speaking on the Mastering Wall Street panel at the Geraci Innovate Conference a few days ago, our Co-Founder Eric Abramovich discussed recent bridge loan securitization pricing and how Roc Capital has been able to keep rates competitive for our clients.

Looking Back at 2021, Looking Forward to 2022

Eric Abramovich, Roc Capital Co-Founder and Chief Credit Officer, looks back at 2021 and shares his thoughts on what we might expect in 2022.

Everything You Wanted to Know About Table Funding But Didn’t Know Whom to Ask

Eric Abramovich, Roc Capital Co-Founder and Chief Credit Officer, takes us on a journey of table funding — its history, how it works, and its role in bringing institutional capital to the “Wild West” world of private lending in real estate investing.

Bullish Outlook for U.S. Housing: My Thoughts from IMN’s Single Family Rental Forum in Miami

Share on facebook Share on twitter Share on linkedin What’s the outlook for the U.S. housing market in general, and rental housing in particular? Overwhelmingly