What’s the outlook for the U.S. housing market in general, and rental housing in particular? Overwhelmingly bullish, from the vibe at IMN’s Single Family Rental Forum (East) in Miami last week. I was there with a small team, and we all came back feeling good about where the market is headed and how Roc Capital is uniquely positioned to address the financing needs of a diverse range of investors.

First off, it’s great that we’re doing in-person events again. Online conferences are all very well, but there’s nothing like meeting people face to face, getting the true sense of their excitement, and talking about how we can help them. It’s even better when some of these conversations take place in balmy Miami weather at an exclusive party that you’re hosting (more on that later)!

So, my key learnings and takeaways from Miami:

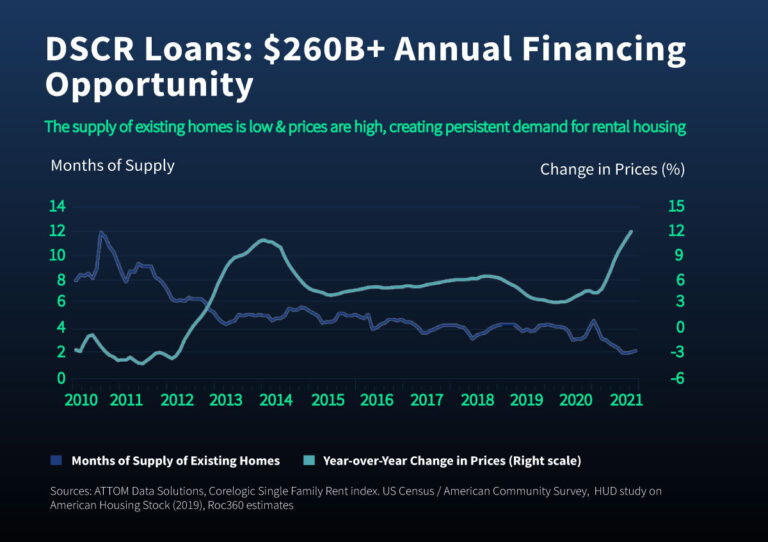

Strong tailwinds for housing prices. The tailwinds behind housing prices have never been better. Low inventory of housing supply, shifts in consumer behavior such as more people working from home, pandemic-accelerated migration trends, and millennials making lifestyle changes have all contributed to making the housing sector hot. Add to that cyclical factors like historically low interest rates and high money supply, and you have a very positive outlook for the foreseeable future.

Private/non-bank capital is more attractive in rentals. In the post-COVID world, private/non-bank capital has become a more attractive alternative to traditional bank/agency financing in the 1-4 unit family rental market. A couple of reasons:

Underwriting is property focused–there is no DTI (debt to income) based borrower underwriting or requirement to submit tax returns.

Agencies and banks restrict the number of investment properties they lend on by specific borrowers, or are often restricted by geographic footprint.

Private lenders like Roc Capital have an advantage. With a diverse base of capital, private lenders like Roc Capital can offer the flexibility, execution, and partnership with borrowers at a scale that banks and agencies are unable to match.

We’re a great fit for both individual and institutional investors

Listening to event attendees in Miami, it was clear to me that Roc Capital is uniquely positioned to address the financing needs of the single family rental (SFR) market across the board– from “mom-and-pop” owners to institutional-level investors, thanks to our comprehensive offerings:

5, 10, or 30 year loans

Single properties, rental portfolios, multifamily, and mixed use properties from $75,000 to $50+ million

30-year fixed or 5/1, 7/1, 10/1 ARMs, with up to 10 years’ IO

Easy step down prepay options

It goes without saying that, if you have an investment opportunity to discuss, we want to talk to you! Just reach out to us at lenders@marketing-dev.roccapital.com.

I shared most of these thoughts in the two panels that I was part of at the event (thanks, IMN, for the opportunity). Other highlights for me included talking to people in the Roc Capital booth and co-hosting an exclusive party on the first evening. As you can see from the pics, people were clearly having a good time at the party — I know I was!

A huge thank you to everyone who visited our booth, attended my panels, or came to our party!

I’ll be back from time to time to share my perspectives on the housing market. Cheers until then.

About the author

Ranajoy Sarkar is the Chief Product Officer at Roc Capital, a lender providing bridge and term loans on non-owner occupied 1-4 family and multifamily properties nationwide, with over $3 billion in funded loans.

He spent over 10 years as a portfolio manager covering the residential/commercial mortgage and structured credit sectors, most recently at Napier Park Global Capital, a multi‐strategy asset manager with over $15 billion in AUM, and its predecessor Citi Capital Advisors, a division of Citigroup. Ranajoy started his career on Wall Street in the fixed income sales and trading division at Lehman Brothers in 1998 and at Bear Stearns as a Managing Director in the Fixed Income division before his move to the buy side of the business.

He has a Bachelor of Technology in Aerospace Engineering from the Indian Institute of Technology, Kanpur, India and an M.B.A. from the John M. Olin School of Business at Washington University in St. Louis.