A Bridge Over Troubled Waters

New loan products from Roc Capital are helping borrowers adapt to higher interest rates and a slowdown in housing market activity.

By Ranajoy Sarkar, Chief Credit and Product Officer

Rates are unlikely to move lower any time soon

Roc Capital can help you adapt and thrive

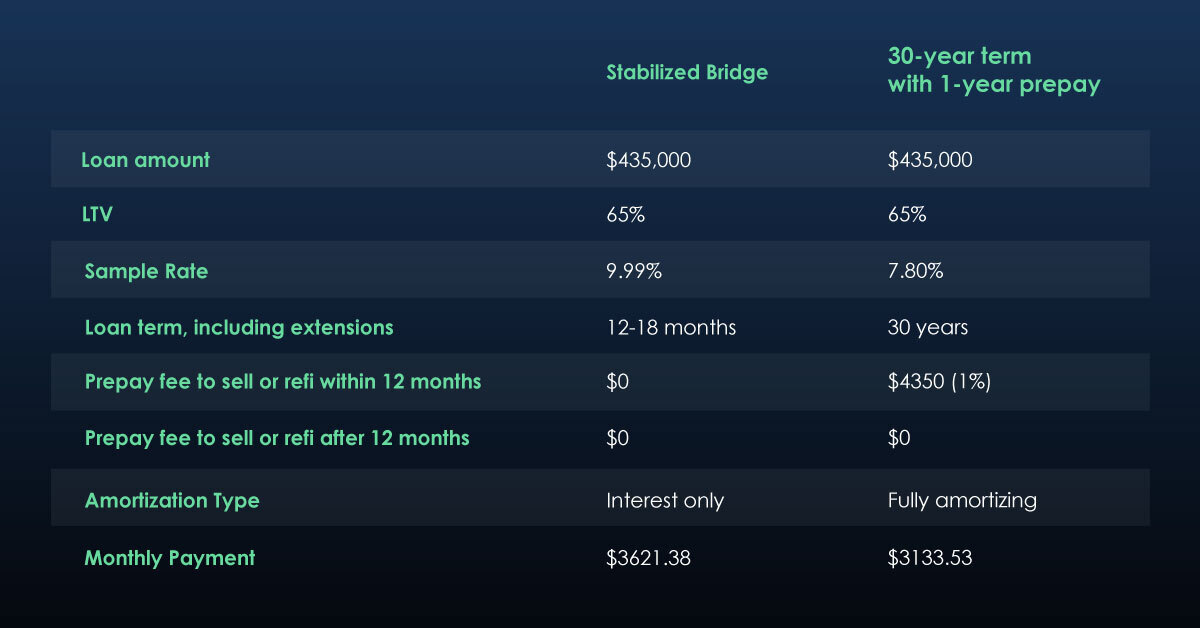

- Stabilized Bridge Loans: short term financing for rent-ready properties, with no prepayment penalties and cash out options, ideal for quick close transactions on properties that require no renovations or to refinance existing finished projects that have short term loans that are coming due.

- 1-year PPP (prepayment penalty) on 30-year Term Loans: long term financing on rent-ready properties with free prepayment after 12 months, for borrowers that are more rate sensitive and/or for those that want to avoid the balloon payment risk associated with short term bridge financing.

Sell in an uncertain market; or rent and refi?

- Stabilized Bridge. The borrower can take our 12-18 month Stabilized Bridge loan with no prepayment penalty. This bridge loan would have a higher interest rate than a term loan, but provides complete flexibility on prepayment and potentially lets the borrower take some cash out in the process, based on the property’s ARV and market rent.

- 30-year Term Loans with 1-year Prepay. If the borrower’s time horizon for exit is at least a year, (e.g. they have a tenant with an annual lease and are not likely to sell the property within a year), the 30-year term loan option with free prepayment after 12 months could be the more attractive option in this scenario. Borrowers get the twin benefits of a lower rate compared to an equivalent bridge loan option and the flexibility of remaining in a 30-year loan if rates continue to stay high or go higher a year from now, thus avoiding the balloon payment risk associated with a bridge loan.

Roc Capital is here for you.

We’re here to fund your loans. Our white label table funding model continues to persevere in these times as it did during the dark days of COVID. We focus on managing risk while you continue to originate great loans. We can help your lending business stay balance-sheet-lite. We fund your loans in your company name reliably and consistently. Our products and services have been designed specifically to ensure your success and that of your customers. Our technology suite, full back-office support, and concierge service provide you with unmatched resources in the market. Our entire team of over 350 people has your back and we will work tirelessly for you.

Want to learn more about Stabilized Bridge, 1-year PPP 30-year Term or our other products that help you ride out these rough times? Get in touch with us today!

-

Fix & Flip

short term loans to buy, renovate, and either sell or own-to-rent 1-4 unit homes.

-

Ground Up Construction

short term loans to buy land and build to sell/own-to-rent 1-4 unit homes.

-

Multifamily Bridge (Purchase)

short term loans to buy, renovate, and sell/own-to-rent 5+ unit multifamily properties.

See our recent posts

The Case for Diversifying into Residential Investment Property Loans

If you’re a loan originator focused on owner-occupied consumer mortgages, you’re probably experiencing a bit of nostalgia for the strong refinance activity that drove origination volumes sky-high in 2020 and 2021.

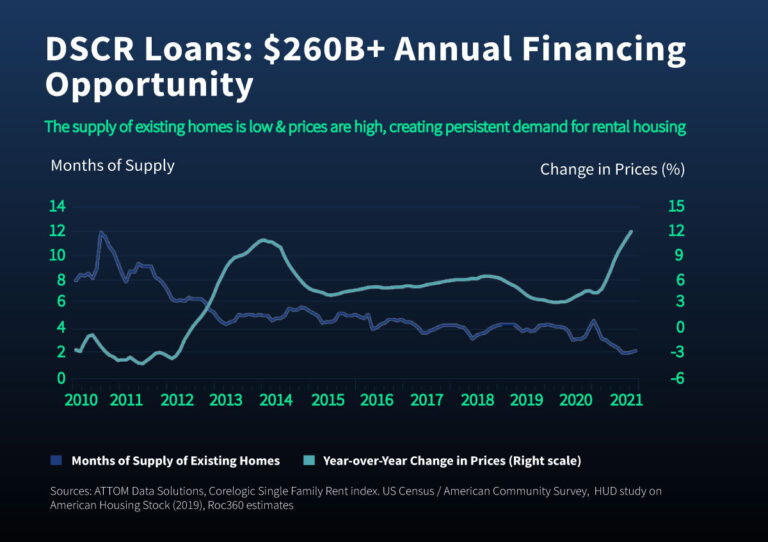

Financing Untapped Equity in Properties Owned by Non-professional Real Estate Investors

Ranajoy Sarkar, Roc Capital’s Chief Credit and Product Officer, is optimistic about the long-term health of the rental market and excited by the prospects of financing the significant untapped equity in properties owned by non-professional real estate investors.

The Private Lending Market Today: Cautious but Optimistic

Despite today’s macroeconomic conditions, the mood in private lending is cautious but still optimistic, says Roc Capital’s Adam Gottfried. A key reason: the fundamentals of real estate have never been stronger.

How Roc Capital Makes Loan Originations Fast, Easy, and Efficient

Roc Capital is uniquely positioned to be your trusted partner, especially in this rising rate market, thanks to our wide range of products, customer-friendly processes, a comprehensive suite of services ranging from white label table funding to full back office support and a full technology suite.

How Roc Capital Kept Rates Competitive for Our Clients

Speaking on the Mastering Wall Street panel at the Geraci Innovate Conference a few days ago, our Co-Founder Eric Abramovich discussed recent bridge loan securitization pricing and how Roc Capital has been able to keep rates competitive for our clients.

Looking Back at 2021, Looking Forward to 2022

Eric Abramovich, Roc Capital Co-Founder and Chief Credit Officer, looks back at 2021 and shares his thoughts on what we might expect in 2022.

Everything You Wanted to Know About Table Funding But Didn’t Know Whom to Ask

Eric Abramovich, Roc Capital Co-Founder and Chief Credit Officer, takes us on a journey of table funding — its history, how it works, and its role in bringing institutional capital to the “Wild West” world of private lending in real estate investing.

Bullish Outlook for U.S. Housing: My Thoughts from IMN’s Single Family Rental Forum in Miami

Share on facebook Share on twitter Share on linkedin What’s the outlook for the U.S. housing market in general, and rental housing in particular? Overwhelmingly